Getting My Feie Calculator To Work

Table of ContentsThe smart Trick of Feie Calculator That Nobody is DiscussingFeie Calculator for BeginnersWhat Does Feie Calculator Do?Getting The Feie Calculator To WorkAn Unbiased View of Feie CalculatorFeie Calculator for BeginnersThe Facts About Feie Calculator Uncovered

If he 'd regularly taken a trip, he would certainly rather finish Part III, detailing the 12-month duration he met the Physical Existence Test and his traveling background. Action 3: Coverage Foreign Revenue (Part IV): Mark made 4,500 per month (54,000 every year).Mark determines the exchange rate (e.g., 1 EUR = 1.10 USD) and converts his income (54,000 1.10 = $59,400). Considering that he lived in Germany all year, the percentage of time he resided abroad during the tax obligation is 100% and he gets in $59,400 as his FEIE. Mark reports complete wages on his Kind 1040 and enters the FEIE as a negative amount on Schedule 1, Line 8d, reducing his taxable earnings.

Selecting the FEIE when it's not the finest option: The FEIE may not be perfect if you have a high unearned revenue, make more than the exemption restriction, or stay in a high-tax nation where the Foreign Tax Credit Scores (FTC) may be a lot more helpful. The Foreign Tax Obligation Credit Score (FTC) is a tax decrease method frequently made use of in combination with the FEIE.

The Greatest Guide To Feie Calculator

deportees to offset their united state tax obligation debt with foreign income taxes paid on a dollar-for-dollar reduction basis. This suggests that in high-tax countries, the FTC can typically eliminate united state tax debt totally. The FTC has constraints on eligible tax obligations and the maximum case quantity: Qualified taxes: Only income tax obligations (or taxes in lieu of revenue tax obligations) paid to international governments are qualified (American Expats).

tax obligation obligation on your foreign revenue. If the foreign tax obligations you paid exceed this limit, the excess international tax can typically be carried forward for approximately ten years or returned one year (by means of an amended return). Maintaining precise records of foreign earnings and tax obligations paid is for that reason vital to computing the right FTC and maintaining tax conformity.

expatriates to lower their tax responsibilities. For example, if a united state taxpayer has $250,000 in foreign-earned revenue, they can exclude approximately $130,000 using the FEIE (2025 ). The remaining $120,000 may after that undergo taxation, however the united state taxpayer can possibly use the Foreign Tax obligation Credit score to balance out the tax obligations paid to the international nation.

Getting The Feie Calculator To Work

He offered his U.S. home to establish his intent to live abroad permanently and applied for a Mexican residency visa with his partner to assist satisfy the Bona Fide Residency Test. Furthermore, Neil secured a long-term residential or commercial property lease in Mexico, with strategies to eventually purchase a property. "I presently have a six-month lease on a home in Mexico that I can prolong one more six months, with the intention to get a home down there." Nevertheless, Neil explains that purchasing residential or commercial property abroad can be challenging without first experiencing the area.

"We'll most definitely be beyond that. Even if we return to the United States for physician's visits or business phone calls, I doubt we'll spend more than thirty day in the United States in any kind of given 12-month period." Neil highlights the relevance of rigorous monitoring of U.S. gos to. "It's something that individuals need to be actually thorough concerning," he says, and advises expats to be careful of usual errors, such as overstaying in the united state

Neil bewares to stress to U.S. tax authorities that "I'm not conducting any type of organization in Illinois. It's simply a mailing address." Lewis Chessis is a tax obligation advisor on the Harness platform with considerable experience assisting united state residents browse the often-confusing realm of global tax obligation conformity. Among the most typical false impressions amongst united state

The Best Guide To Feie Calculator

tax obligation return. "The Foreign Tax Credit rating enables individuals operating in high-tax countries like the UK to offset their U.S. tax liability by the amount they've currently paid in taxes abroad," claims Lewis. This ensures that deportees are not tired twice on the very same income. Those in low- or no-tax countries, such as the UAE or Singapore, face added obstacles.

The prospect of lower living expenses can be appealing, but it frequently features compromises that aren't instantly apparent - https://www.huntingnet.com/forum/members/feiecalcu.html?simple=1#aboutme. Real estate, as an example, can be more affordable in some nations, yet this can imply endangering on facilities, security, or access to trustworthy energies and services. Cost-effective buildings may be located in locations with inconsistent internet, minimal public transportation, or undependable medical care facilitiesfactors that can significantly affect your daily life

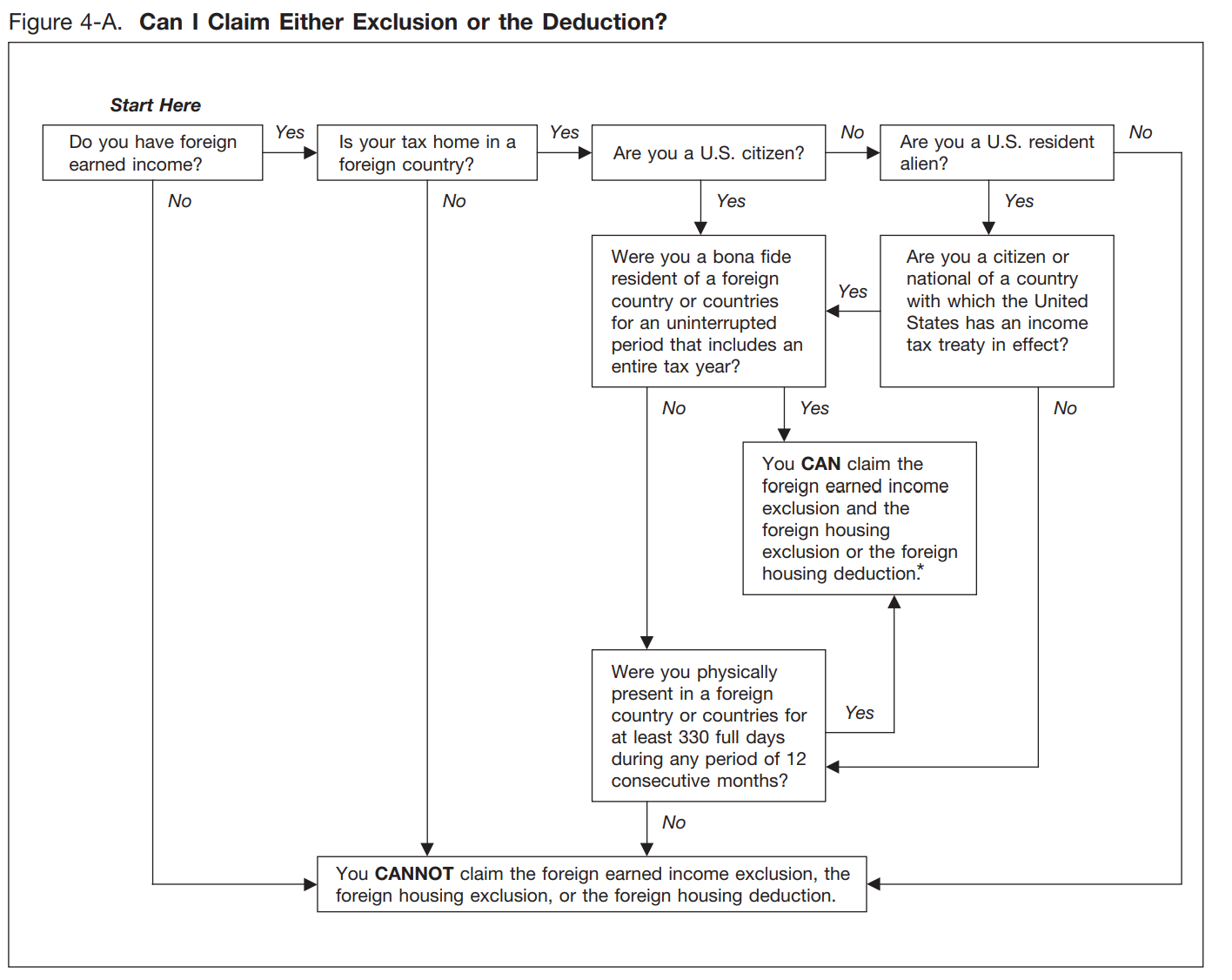

Below are some of the most often asked questions concerning the FEIE and other exemptions The International Earned Earnings Exclusion (FEIE) allows U.S. taxpayers to leave out approximately $130,000 of foreign-earned income from government revenue tax, decreasing their U.S. tax liability. To receive FEIE, you need to fulfill either the Physical Visibility Test (330 days abroad) or the Bona Fide Home Examination (prove your key residence in an international country for a whole tax obligation year).

The Physical Existence Test needs you to be outside the united state for 330 days within a 12-month period. The Physical Presence Examination additionally calls for U.S. taxpayers to have both an international revenue and an international tax obligation home. A tax home is specified as your prime location for organization or work, despite your household's house. https://louisbarnes09.wixsite.com/feie-calculator.

What Does Feie Calculator Mean?

An income tax treaty in between the U.S. and an additional nation can aid avoid dual tax. While the Foreign Earned Income Exclusion decreases gross income, a treaty may offer added benefits for qualified taxpayers abroad. FBAR (Foreign Bank Account Record) is a required declare U.S. people with over $10,000 in foreign economic accounts.

The international gained earnings exemptions, occasionally referred to as the Sec. 911 exemptions, leave out tax obligation on incomes made from functioning abroad.

Rumored Buzz on Feie Calculator

The tax obligation advantage omits the earnings from tax at bottom tax obligation prices. Previously, the exemptions "came off the top" reducing earnings subject to tax at the leading tax obligation rates.

These exclusions do not spare the wages from United States tax yet simply offer a tax obligation reduction. Keep in mind that a single person functioning abroad for all of 2025 who gained regarding $145,000 without various other income will have taxed income minimized to zero - properly the same answer as being "tax totally free." The exemptions are computed every day.

If you went to organization meetings or seminars in the US while living abroad, earnings for those days can not be left out. Your earnings can be paid in the United States or abroad. Your company's area or the area where earnings are paid are not factors in getting the exclusions. American Expats. No. For US tax it does not matter where you keep your funds - you are taxable on your globally income as an US person.

Comments on “Unknown Facts About Feie Calculator”